Valuation is a key topic in real estate. There are numerous methods used for this purpose, used by market players such as real estate agents, surveyors, developers, investors, and notaries.

The aim of this article is to explain to you how to value a property using the right method in your situation .

Valuation by reconstruction value

The reconstruction value is certainly the simplest to understand and apply. This is the method used by insurance companies to determine the amount to be compensated. It simply involves considering that an identical property will be rebuilt on the land (already acquired) and applying a depreciation factor, based on the condition of the property (often a simple coefficient relative to the year of construction).

We must therefore distinguish two reconstruction values:

- The new reconstruction value : this is simply the value of a similar property to be built

- The reconstruction value: this is the reconstruction value from new to which a depreciation factor (discount) is applied

| Price of new reconstruction | 300.000€ |

| Obsolescence coefficient (depending on the age of the building) | 0,7 |

| Reconstruction value | 300,000 x 0.7 = 210,000€ |

According to the above calculation, a reconstruction value does not allow the building to be rebuilt identically since a reduction factor has been applied to the new reconstruction value.

Note that for the value by reconstruction to be comparable to other methods, the value of the land must be added (which is automatically included in the other methods).

Why add land value? When you rebuild a building, the cost of the land doesn't disappear, since the land remains unchanged. The cost of reconstruction only takes into account the cost of rebuilding the building, but land also has value, often significant in certain areas (e.g., city centers or desirable locations).

So, if the reconstruction value of the building after its deterioration is €210,000, the value of the land must be added to obtain a complete estimate. For example, if the land is worth €100,000, the total value of the building would be €210,000 (building) + €100,000 (land), or €310,000.

Valuation by capitalization of income

In the capitalization approach, the value is related to the rental income of the property . The equation for the value of the property is:

Present Value = Net Operating Income / Capitalization Rate

The capitalization rate is determined based on observation of the local market and the segment considered. In fact, the capitalization rate depends on:

- Location: The capitalization rate is lower in good locations. The underlying logic is that an investor will accept a slightly lower rent if the location is very good. Conversely, to attract an investor in a smaller city, the capitalization rate will have to be high (proportional to the yield).

- The segment: the capitalization rate in commercial and retail real estate is higher than in residential, particularly to cover the risk of rental unemployment.

For example, an investment property with an annual net operating income of €700,000 and a capitalization rate of 6% would be worth €11.7 million.

The advantage of this method is that it takes into account the real yield of the property. It tends to overestimate properties with a good yield (e.g., student housing buildings) and underestimate properties with a poor yield (e.g., single-family homes).

Looking to determine rental income or capitalization rate in a specific case? Check out our article on how to value a property by capitalization to learn how to get this information directly into our Market Explorer analysis tool.

Valuation by comparison

Also called the "points of comparison method," this is probably the most widely used and intuitive method , as it simply involves comparing a property with similar properties nearby . These properties will then be compared, taking into account their similarities and differences.

Indeed, no two properties will ever be exactly alike. One may have been partially renovated while the other has not; one may also have a veranda, a swimming pool, or another feature that increases its market value.

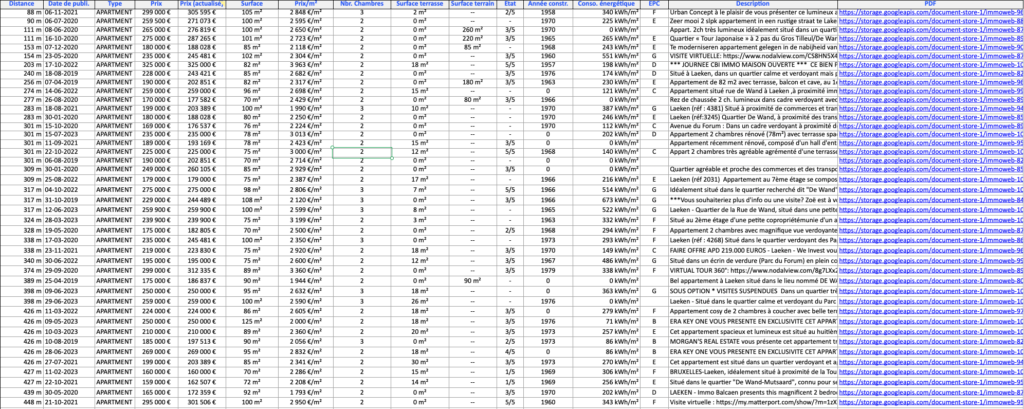

You will first need to obtain comparables (via an ad site or a comparison points tool ) in order to list them in an Excel table with the essential characteristics.

For a residential property, here is the main information to collect:

- The date of sale or listing

- The price

- The number of rooms

- The living area (as shown on the PEB energy certificate, for example)

- The condition of the property

- Energy performance

Here is a table of comparison points obtained using the application Market Explorer :

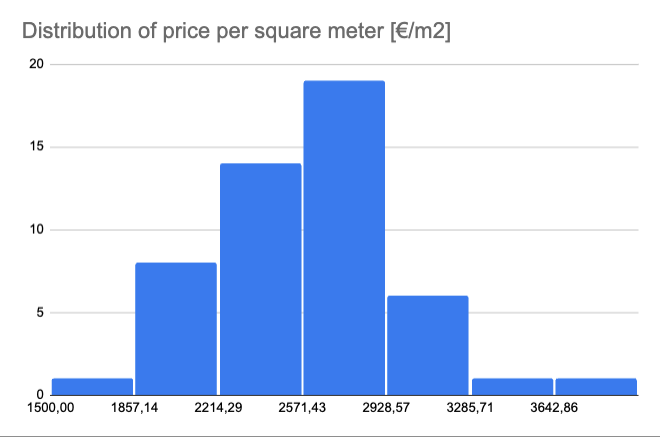

It is then very useful to calculate the price/m2 , the average price or to create a price histogram . This will allow you to complete your analysis with the minimum, median and maximum price of the sample.

Using the histogram, we can see that 19 properties are in the range of €2,570/m2 to €2,928/m2 . However, there is only one property below €1,857/m2 and one property above €3,642/m2. For this sample, the median price is €2,597/m2.

Comparison of methods

Although these methods are complementary, some of them are preferable in specific contexts. This is what we will see below:

| Method | Use cases | Necessary data | Benefits | Disadvantages |

|---|---|---|---|---|

| Reconstruction value | Insurance | – Construction price (€/m2) – Gross area (m2) – Level of obsolescence | ✅ Easy to calculate ✅ Need little information | ❌ Simplistic approach ❌ Sometimes quite far from market values ❌ High sensitivity of the result in relation to the chosen obsolescence coefficient |

| Capitalization value | Investment property: apartment building, student accommodation, office building or retail space. | – Actual or estimated rent – Capitalization rate | ✅ Allows you to put yourself in the investor's position, with a return in mind – Often allows you to obtain more than by other methods if the building is profitable | ❌ Sometimes gives “off-market” values, if the property is very profitable (e.g.: AirBNB rental) |

| Value by comparison | Property not intended for yield | – Points of comparison | ✅ Method taking into account the real state of the market | ❌ Need to obtain points of comparison, sometimes difficult to find |

It is often very useful and instructive to compare the values obtained by the different methods, particularly in the case of a change of use (office to residential, traditional housing to student housing).

Example

Let's take the case of a 200 m² house on a 1000 m² plot on the outskirts of Nivelles (Walloon Brabant).

| Method | Calculation | Value obtained |

|---|---|---|

| Valorization by reconstruction | – Ground : €170,000 (€170/m2) – Construction : €360,000 (€1,800/m2) – Obsolescence : 25% – Reconstruction value : 424.000€ | 424.000€ |

| Valuation by capitalization | – Rent : €1,280/month (€6.4/m2) – Capitalization rate : 3.4% | 384.000€ |

| Valuation by comparison | – Median specific price : €2,088/m2 – Total price : €417,600 | 417.600 |

It is interesting to note the following:

- For an investor, the expected return will likely be at least 4% gross. To invest in the property, taking into account the rent and the expected return, the investor will therefore not want to spend more than €384,000 (i.e., 8% less than the comparative value).

- The reconstruction value is quite sensitive to the chosen obsolescence coefficient. By varying it by 5% upwards and downwards, we obtain a range of €397,000 to €450,500.

- For an investment property, you can calculate the value by capitalization (because it is an investment property) and divide the value by the surface area to obtain the price/m2. You can then compare this price/m2 to that obtained by comparison.

Conclusions

We have seen three valuation methods:

- Valuation by reconstruction value

- Valuation by capitalization of income

- Valuation by comparison

Each of these methods can be used in a specific context, but it is always interesting to use them together and compare the results.

Need data for your estimates? Our Market Explorer application has extensive historical data across multiple market segments and across Belgium. Contact us to learn more!