Nous avons analysé les répartitions du Revenu Cadastral, qui définit le Précompte Immobilier en Belgique. Cet article explique pourquoi le précompte immobilier peut être considéré comme opaque et inégalitaire, d’un point de vue statistique !

La méthode de calcul

Le revenu cadastral

Le Revenu Cadastral (RC) constitue la base pour la perception du Précompte Immobilier (PI) et pour la détermination des revenus immobiliers imposables à l’impôt des personnes physiques.

Le RC est un revenu fictif qui correspond au revenu annuel moyen net qu’un bien procurerait à son propriétaire. Dans les esprits, il est censé être représentatif de la « qualité » d’un logement.

Ce revenu fictif a été calculé par l’Administration Générale du Patrimoine (AGDP, ex- Cadastre) pour l’année de référence 1975. Depuis, il n’a plus été mis à jour : pour pallier ce problème, le RC est indexé annuellement. Pour 2024, le SPF Finances a défini une indexation de 2,1763. En 2023, elle était de 2,0915.

Quel impact sur le Précompte Immobilier ?

Le Précompte Immobilier (PI) est calculé de la manière suivante :

Précompte Immobilier = RC indexé x Taux Global

Taux global = taux régional + taux provincial + taux communal (centimes additionnels).

Le taux régional est fixé par la région, le taux provincial par la province, et le taux communal par les communes. À Bruxelles-Capitale et Wallonie le taux régional est de 1,25%. En Flandre, ce taux est de 3,97%.

Ainsi, plus un Revenu Cadastral (RC) sera élevé, plus le précompte immobilier sera élevé. De la même manière, si un RC est mal évalué (à la baisse ou à la hausse) alors le Précompte Immobilier le sera également.

Que se passe-t-il en cas de réévaluation du RC ?

Certaines modifications du bien donne lieu à une réévaluation du RC. Si cette réévaluation est rarement demandée par le contribuable directement, la réévaluation est à l’initiative de l’administration (l’AGDP) après avoir eu connaissance de la modification par source tierce (ex: une demande de permis de construire).

Puisqu’il n’est pas possible de réévaluer la valeur locative du bien en 1975, l’AGDP évalue principalement le RC sur base de points de comparaison, par exemple dans le même quartier. À ce titre, le Précompte Immobilier est un impôt opaque.

Le vrai problème : le RC de 1975 ne correspond plus à la réalité

Le problème du Revenu Cadastral réside dans son actualisation : l’indexation appliquée est globale, c’est-à-dire que tout le monde voit son RC augmenter de la même manière. Et ce sans tenir compte de l’évolution des caractéristiques de chaque bien ou de l’attractivité de leur localisation.

De la même manière, l’image des revenus locatifs potentiels tels que calculée en 1975 ne correspond plus au marché Belge en 2024 : certains quartiers et communes ont vu leur qualité de vie augmenter drastiquement. Très peu de communes ont vu leur Revenu Cadastral réévalué globalement depuis ce jour. [1]

[1] “Réévaluation du revenu cadastral des habitations après transformation”, Rapport de la Cour des comptes transmis à la Chambre des représentants, 2013.

Les inégalités de Revenu Cadastral à Bruxelles

Nous avons vu que le Revenu Cadastral calculé en 1975 pouvait ne plus correspondre à l’état du marché. Certaines communes ont vu leur prix grimper et d’autres leur prix stagner : mais toutes voient leur RC indexé de la même manière.

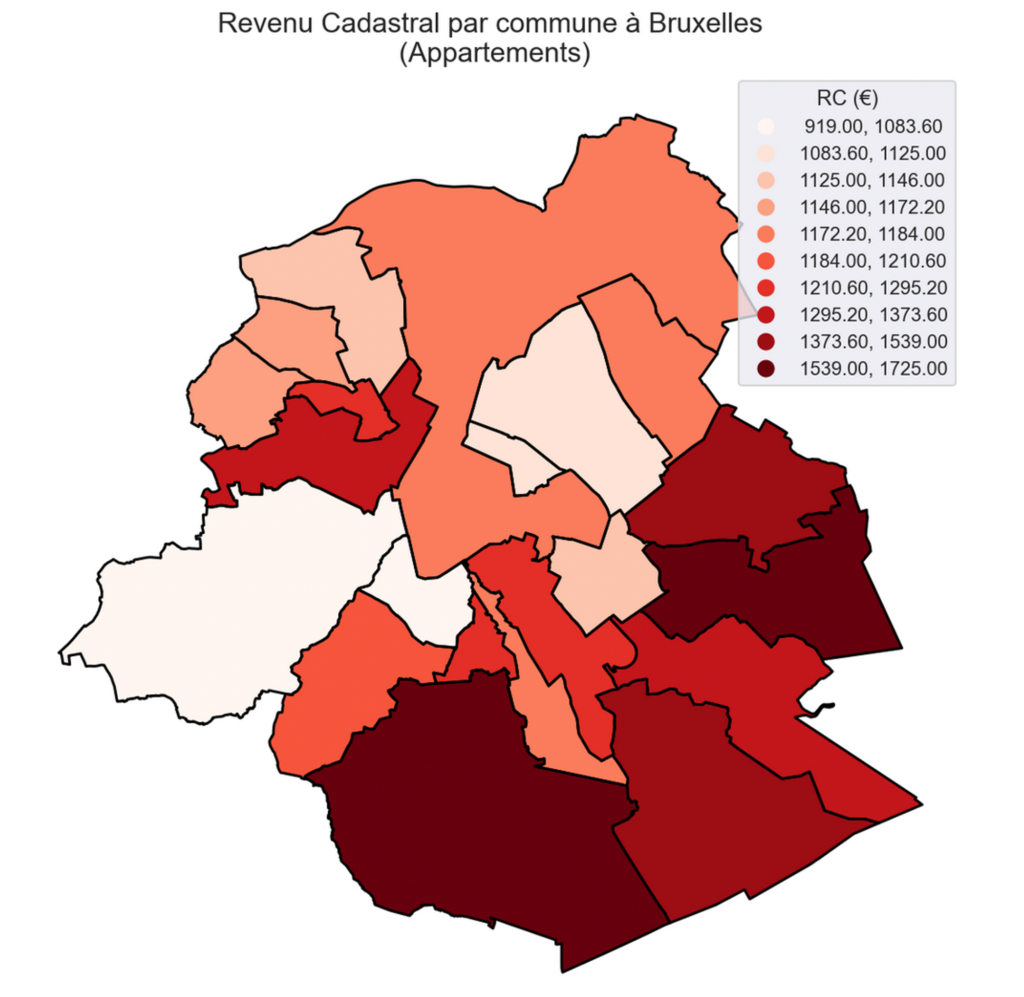

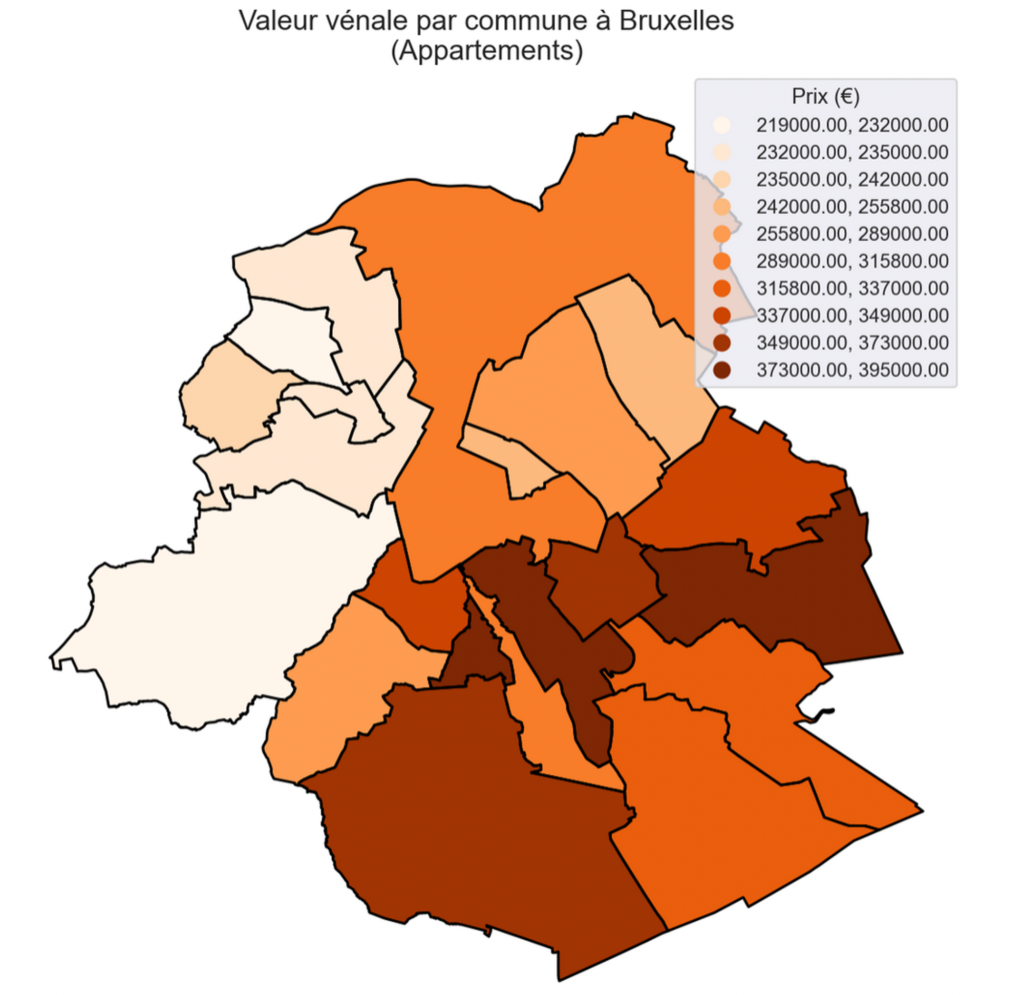

SmartBlock a étudié le Revenu Cadastral dans la Région Bruxelloise :

La carte semble indiquer que les RC les plus élevés sont en effet localisés autour des communes les plus riches, à part quelques cas : Etterbeek, Molenbeek ou Koelkeberg ont des RC soit bas, soit élevés qui ne correspondent pas à la valeur du marché actuelle.

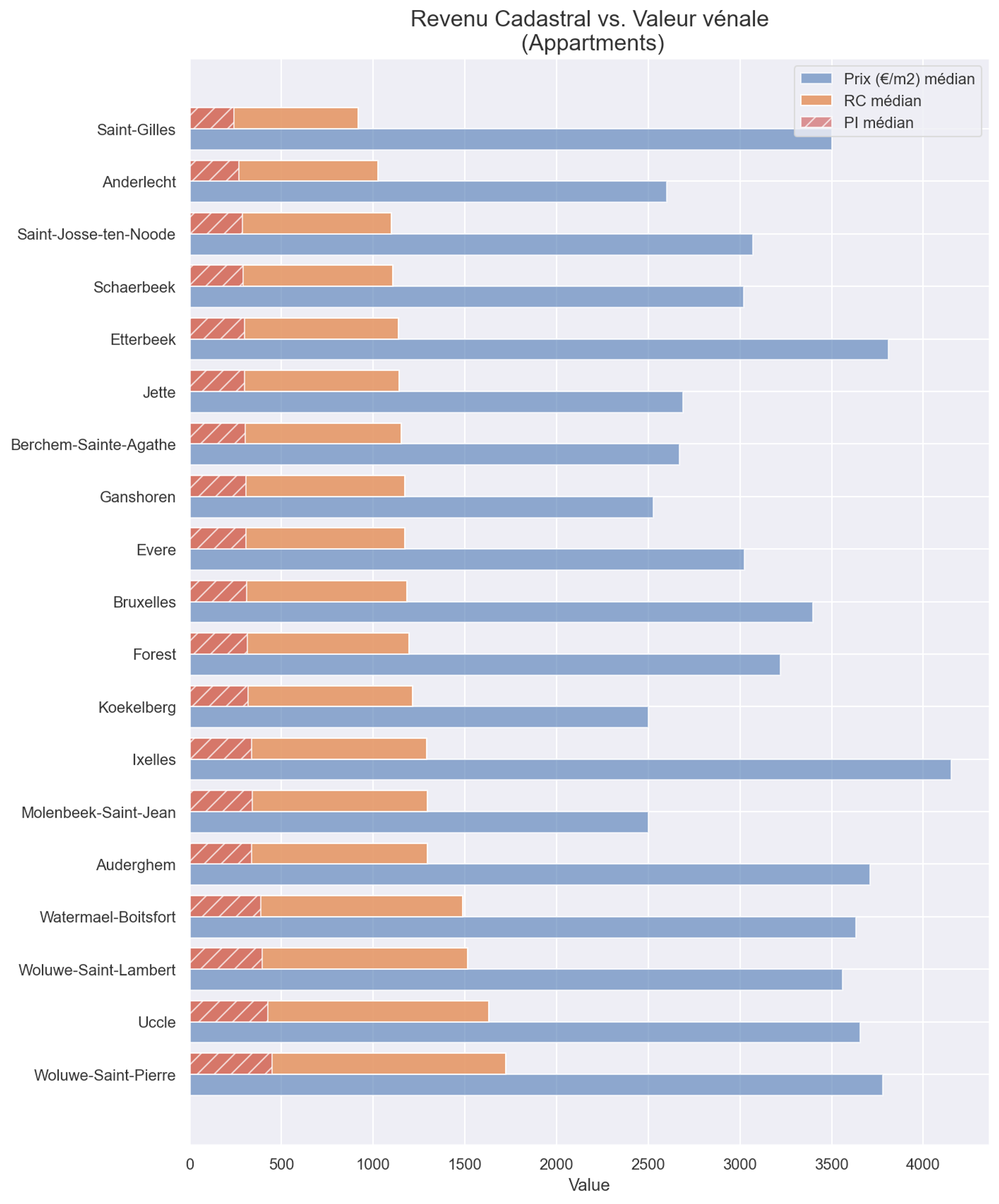

Visualisons maintenant le Revenu Cadastral, Précompte Immobilier et Prix (€/m2) de chaque commune :

Le rapport entre le Revenu Cadastral et le prix de l’immobilier (appartements) fait alors apparaître des disparités :

- On paie un Précompte Immobilier généralement plus bas à Saint-Gilles qu’à Anderlecht (pour le même type de bien)

- On paie un Précompte Immobilier équivalent entre Ixelles et Molenbeek ou même Koekelberg, alors que la valeur des biens immobiliers à Ixelles et 30% plus élevée.

- Etterbeek fait aussi état d’un RC très bas par rapport à la valeur des biens sur son marché.

- Les centimes additionnels, qui sont déterminés par la commune, ne viennent pas compenser cet effet.

💡 Pourquoi cet effet ? Le Précompte Immobilier est basé sur le Revenu Cadastral, calculé en 1975. Depuis 1975 certaines communes ont vu leurs prix s’envoler avec la qualité de la vie : Etterbeek, Saint-Gilles en sont de bons exemples. Voir : l’évolution des prix à Bruxelles-Capitale.

Le Revenu Cadastral ne s’est pas adapté à cette évolution, et certaines communes qui n’ont pas vu la valeur de leurs biens évoluer paient le même RC que celles dont le marché a fait exploser les prix.

… et plus largement en Belgique

Mais cet effet ne se limite pas à la Région Bruxelles-Capitale, puisque l’indexation du RC est identique partout. Ainsi, de grosses disparités se creusent entre province ou district ainsi qu’au niveau du Royaume.

Smartblock a étudié les RC médians de plusieurs villes Belges, pour des biens types : Maison unifamiliale 3 chambres et Appartement 2 chambres.

Maison type (3 ch.)

| Revenu Cadastral médian | Prix de vente médian | ratio | |

|---|---|---|---|

| Bruxelles-Capitale | 1.279 € | 459.000 € | 0.28 |

| Namur | 974 € | 275000 € | 0.35 |

| Antwerpen | 793 € | 345000 € | 0.23 |

| Liège | 684 € | 199000 € | 0.34 |

| Mons | 683 € | 195000 € | 0.35 |

| Brugge | 675 € | 329000 € | 0.21 |

| Gent | 552 € | 358000 € | 0.15 |

| Charleroi | 550 € | 169000 € | 0.33 |

Gent se détache significativement des autres communes par un RC moyen très faible comparé à des prix élevés (dans le top 3) pour des maisons 3 chambres. Suivent ensuite Anvers et Brugges pour les mêmes raisons.

Appartement type (2ch.)

| Revenu Cadastral médian | Prix de vente médian | ratio | |

|---|---|---|---|

| Bruxelles-Capitale | 1.243 € | 294.000 € | 0.42 |

| Namur | 1.086 € | 219.000 € | 0.50 |

| Liège | 981 € | 179.000 € | 0.55 |

| Mons | 975 € | 160.000 € | 0.61 |

| Charleroi | 941 € | 129.000 € | 0.73 |

| Gent | 902 € | 310.000 € | 0.29 |

| Antwerpen | 870 € | 229.000 € | 0.38 |

| Brugge | 862 € | 269.000 € | 0.32 |

Il est déjà remarquable que les RC médians d’un appartement 2ch. sont similaires aux RC de maisons 3ch. (tandis que la surface n’est pas même : respectivement ~90m2 et ~140m2).

Par conséquent, le rapport entre RC et valeur du bien est très élevé. C’est à Charleroi et à Mons qu’il est en proportion très élevé par rapport au prix de vente médian de ce type d’appartement. À nouveau, les trois villes Flamande font état d’un RC très faible comparé aux prix des biens.

💡 Quelle interprétation ? Pour un bien identique, le Revenu Cadastral n’est pas forcément corrélé aux prix de l’immobilier (ni au marché locatif, également corrélé à la valeur vénale). L’indexation, globale, ne corrige pas ce phénomène.

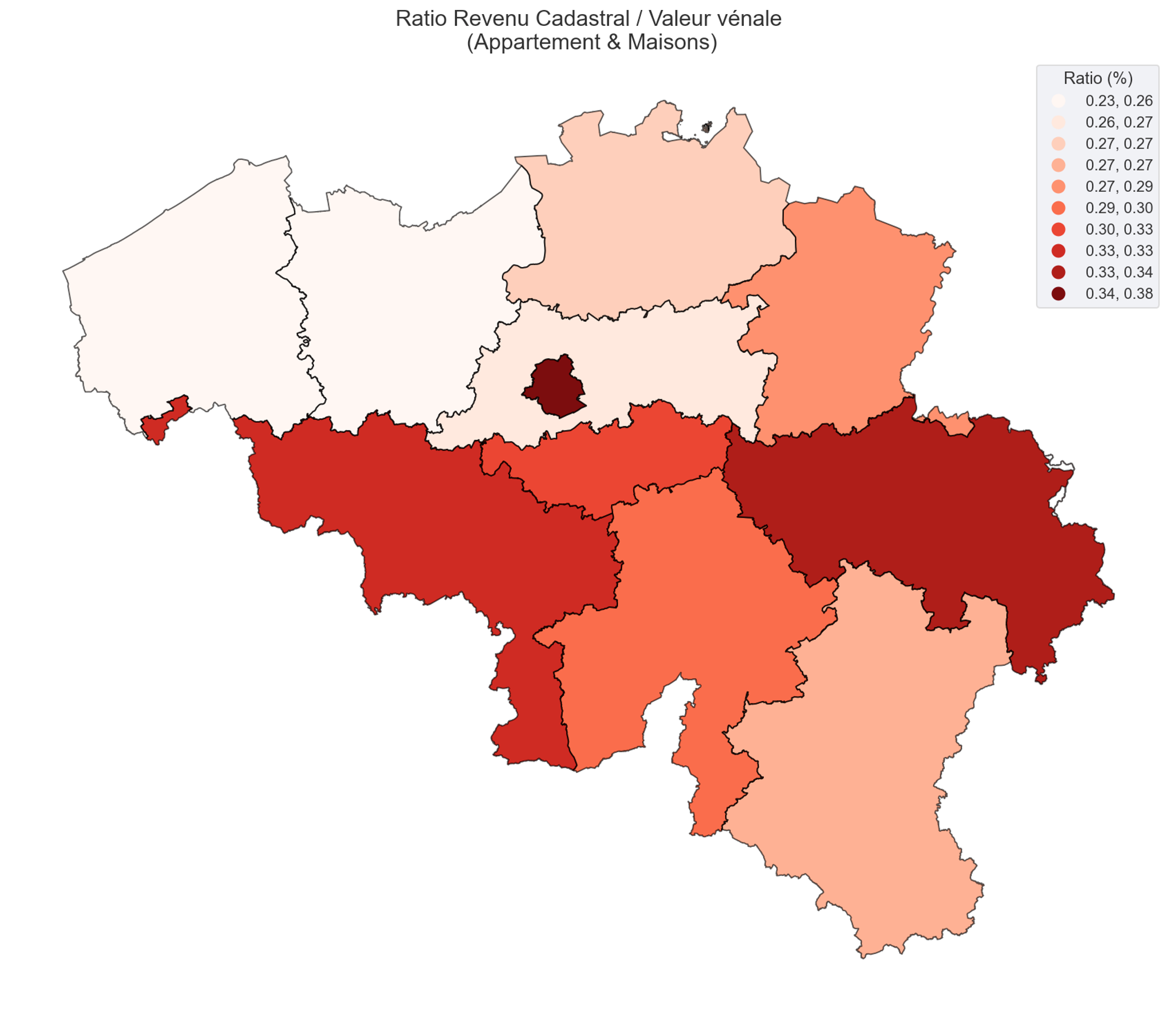

À nouveau, le rapport entre RC et Valeur vénale met en exergue les disparités :

- C’est la province de Liège qui possède un Revenu Cadastral médian le plus élevé par rapport aux valeurs vénales des biens immobiliers (Maisons et appartements).

- C’est à Bruxelles-Capitale et en Flandre que les Revenus Cadastraux sont les plus élevés. Mais, les Flamands ont un RC particulièrement bas par rapport à la valeur vénale de leurs biens.

- La différence entre Flandre et Wallonie est marquée, et c’est globalement en Flandre Occidentale et Flandre Orientale que ce rapport est le plus avantageux.

Conclusion

- Le Précompte Immobilier est basé sur le Revenu Cadastral, un revenu fictif établi pour 1975 et qui n’a pas été revu depuis.

- L’évolution du marché de l’Immobilier a fait prendre en valeur les biens de certaines communes sans que le Revenu Cadastral soit ajusté en conséquence.

- Il existe des disparités entre quartier, et communes : pour un bien similaire, le RC est identique dans des communes qui possèdent un marché de l’immobilier (prix à l’achat, marché locatif) très différents.

- Par conséquent, les propriétaires de biens immobiliers avec une valeur vénale élevée paient un Précompte Immobilier similaire à des biens dans des zones moins favorisés.

- Les révisions du Revenu Cadastrales sont faites au compte-goutte lors de modifications majeures d’un bien. Il est alors possible de faire une réclamation si le nouveau RC est inadéquat, mais il est préférable de venir accompagné d’un d’expert et de données concrètes justifiant le RC soumis à l’administration.

💡 Payez-vous un Précompte Immobilier trop élevé ? SmartBlock a mis en place un simulateur qui permet de calculer son RC et de le comparer à son quartier et sa commune.

Autres remarques statistiques…

- On a vu la presse s’affoler sur l’augmentation des centimes additionnels de certaines communes en 2023 (ex: Forest, Schaerbeek). Il faut remettre en perspective le fait que les centimes additionnels communaux représentent une part globalement faible dans le calcul du taux appliqué au RC. C’est bien la différence de Revenu Cadastral entre commune qui drive les différences de PI entre commune. Exemple:

- Schaerbeek : 4191 centimes additionnels → PI médian 290€

- Woluwe-Saint-Pierre: 1725 centimes additionnels → PI médian de 451€

- Par contre l’augmentation de l’indexation des Revenus Cadastraux de 1,9084 (2022) à 2,0915 (2023) a un impact réel direct sur le précompte Immobilier, puisque c’est cette valeur qui sert de base multiplé au taux régional/provincial/communal.

- Le calcul du Revenu Cadastral est n’est pas évident : SmartBlock a essayé de calculer les revenus locatifs de 200.000 biens et comparé avec leur Revenu Cadastral indexé.

- Si les revenus locatifs sont corrélés au RC indexé en 2023, le Revenu Cadastral est inférieur d’un facteur 3 ou 4.

- Il est difficile de dire que le RC correspond exactement aux revenus locatifs tout comme il est difficile de constater un lien fort avec des caractéristiques de confort souvent mises en avant (présence de chauffage central, nombre de salles de bains, etc.).