Valuing a property by capitalization is generally used in the context of rental investments. In other words, the investor is not buying a property, but rather a return: “given this rent, and since I want a 6% return, what is the maximum price at which I want to buy?”.

Capitalization rate = rental yield?

No. While the two are similar, rental yield includes deed fees (registration duties). The method is called “yield-based valuation” when the yield rate is used.

This article explains how to calculate the value of the property using this methodology.

Theoretical approach

In the capitalization approach, value is linked to the property’s rental income:

Current value = Net operating income / Capitalization rate

Net operating income is the sum of rents received, minus expenses (taxes, withholding tax, etc.). The capitalization rate is determined based on observation of the local market and the segment considered. Indeed, the capitalization rate depends on:

- Location: the capitalization rate is lower in good locations. The underlying logic is that an investor accepts a slightly lower return if the location is very good. Conversely, to attract an investor to a smaller city, the capitalization rate will need to be high (proportional to the return).

- The segment: the capitalization rate in commercial and retail real estate is higher than in residential, notably to cover the risk of rental vacancy (e.g., an office that is not rented).

To take an example, a rental property whose annual net operating income is 700,000 euros with a capitalization rate of 6% would be worth €11.7M.

The advantage of this method is that it takes into account the property’s actual return. However, it tends to overestimate properties with a good return (e.g., a student housing building) and underestimate properties with a poor return (e.g., a single-family house).

In practice, to calculate the value of a property by capitalization, we need two elements:

- The property’s rental income

- The capitalization rate

Determine a rent and a capitalization rate

Using the information available

To determine a property’s rental income, there are three scenarios:

- Either the building is 100% rented

- Either the building is partially rented (80% rented: 5 apartments of which 1 is currently vacant)

- Either the building is not rented: this is the case if the lease has just ended or if the owner occupied the property

If we have lease agreements, the rental value indicated on them can serve as a basis to justify the property’s actual rental income. If the property is not rented or partially rented, an estimated rent value will need to be determined.

For the capitalization rate, we can rely on market knowledge and an investor’s expectations (minimum return). But it is always useful to know the yield observed in a specific geographic area and for a particular segment.

Using a market analysis tool

Without market knowledge or a current lease, it is more complicated to establish a reference rent for the expected investment. You can use the comparable points tool Market Explorer, which will make it possible to extract the following financial information:

- price per square meter;

- rent per square meter;

- gross rental yield (calculated based on the two previous values).

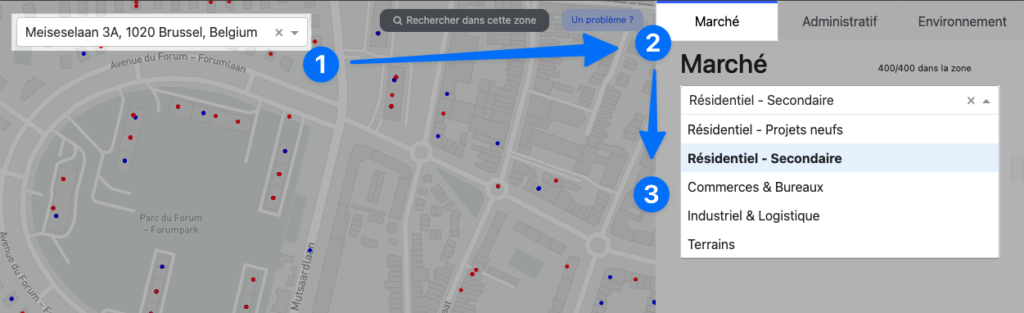

Let’s take an example with an apartment of ±90m2 in Brussels, Mutsaard neighborhood. Let’s start by entering an address and selecting a market (Secondary residential market for example):

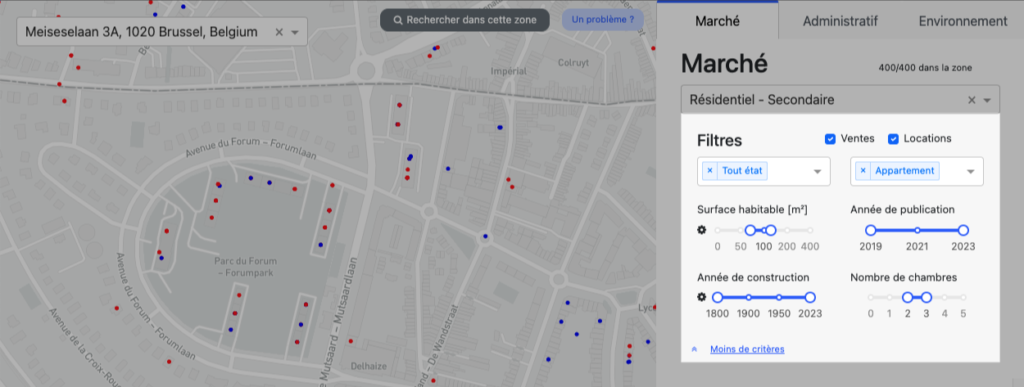

Once the dropdown menu is collapsed, we click on “More criteria” to make the filter panel appear. This will allow us to refine the search on our segment (2-3 bedroom apartment) and to have only comparables that are fairly similar in terms of condition and surface area. Note: the more you filter, the fewer points there will be on the map!

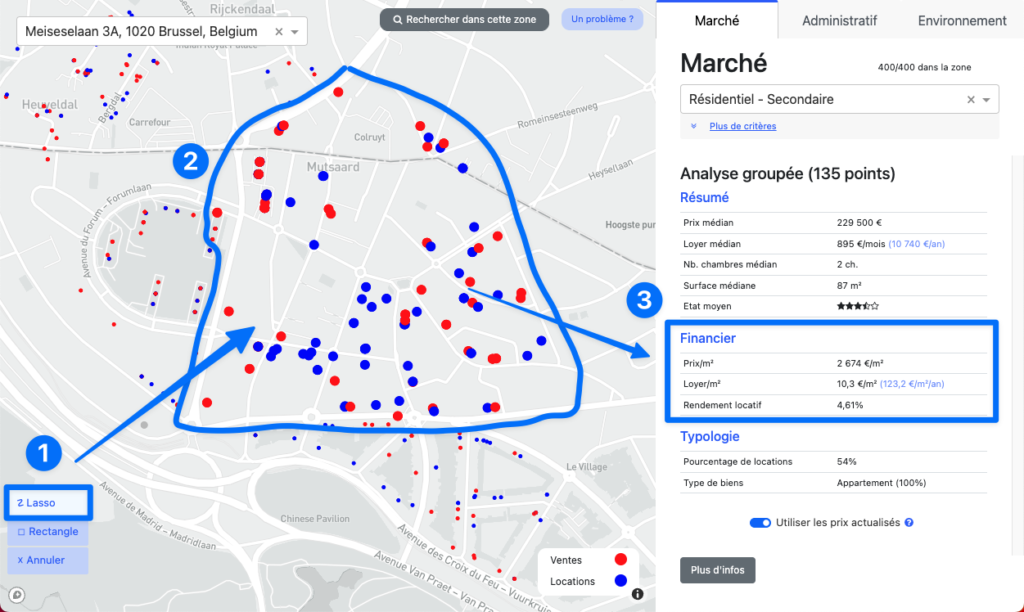

When the filters are applied, we can freely select a group of points with the Lasso tool (here the Mutsaard neighborhood in Brussels) corresponding precisely to your area of interest.

We see that for an apartment of about 90 m² in the neighborhood, the rent will be €927/month (€10.3/m2 x 90m2). The capitalization rate for this segment and in this neighborhood is 4.61%. We can then estimate the value of this property at €241,000.

Why does the application display “rental yield” instead of capitalization rate?

For the sake of simplification, this terminology was used to be understandable to as many people as possible. The displayed value does not take into account registration fees and is therefore comparable to the capitalization rate.

This data provides an excellent basis for the calculation since it takes into account the precise location (thanks to the lasso) as well as the exact typology studied (thanks to the filters).

Conclusion

We have seen what the capitalization valuation method is, and how to determine a market rent and a reference capitalization rate for a given segment.

Of course, this article is only intended to illustrate the capitalization calculation and does not replace a visit, the intervention of an expert, or an agent who can assess specific elements that will increase or decrease the value of a property.