We analyzed the distributions of Cadastral Income, which determines the Property Tax in Belgium. This article explains why the property tax can be considered opaque and unequal, from a statistical point of view!

The calculation method

Cadastral income

Cadastral Income (CI) forms the basis for levying the Property Tax (PT) and for determining real-estate income taxable under personal income tax.

The CI is a notional income that corresponds to the average net annual income a property would provide to its owner. In people’s minds, it is supposed to be representative of the “quality” of a home.

This notional income was calculated by the General Administration of Patrimony (AGDP, formerly the Cadastre) for the reference year 1975. Since then, it has no longer been updated: to address this problem, the CI is indexed annually. For 2024, the FPS Finance set an indexation of 2.1763. In 2023, it was 2.0915.

What impact on the Property Tax?

The Property Tax (PT) is calculated as follows:

Property Tax = indexed CI x Overall Rate

Overall rate = regional rate + provincial rate + municipal rate (additional centimes).

The regional rate is set by the region, the provincial rate by the province, and the municipal rate by the municipalities. In Brussels-Capital and Wallonia the regional rate is 1.25%. In Flanders, this rate is 3.97%.

Thus, the higher a Cadastral Income (CI) is, the higher the property tax will be. Likewise, if a CI is mis-assessed (too low or too high), then the Property Tax will be as well.

What happens in the event of a reassessment of the CI?

Certain changes to the property lead to a reassessment of the CI. While this reassessment is rarely requested directly by the taxpayer, it is initiated by the administration (the AGDP) after it becomes aware of the change via a third-party source (e.g., a building permit application).

Since it is not possible to reassess the property’s rental value in 1975, the AGDP mainly assesses the CI on the basis of comparable properties, for example in the same neighborhood. In this respect, the Property Tax is an opaque tax.

The real problem: the 1975 CI no longer matches reality

The problem with Cadastral Income lies in how it is updated: the indexation applied is global, meaning everyone sees their CI increase in the same way. And this without taking into account changes in each property’s characteristics or the attractiveness of its location.

Similarly, the picture of potential rental income as calculated in 1975 no longer matches the Belgian market in 2024: some neighborhoods and municipalities have seen their quality of life increase drastically. Very few municipalities have had their Cadastral Income reassessed globally since then. [1]

[1] “Reassessment of the cadastral income of dwellings after transformation”, Report of the Court of Audit submitted to the Chamber of Representatives, 2013.

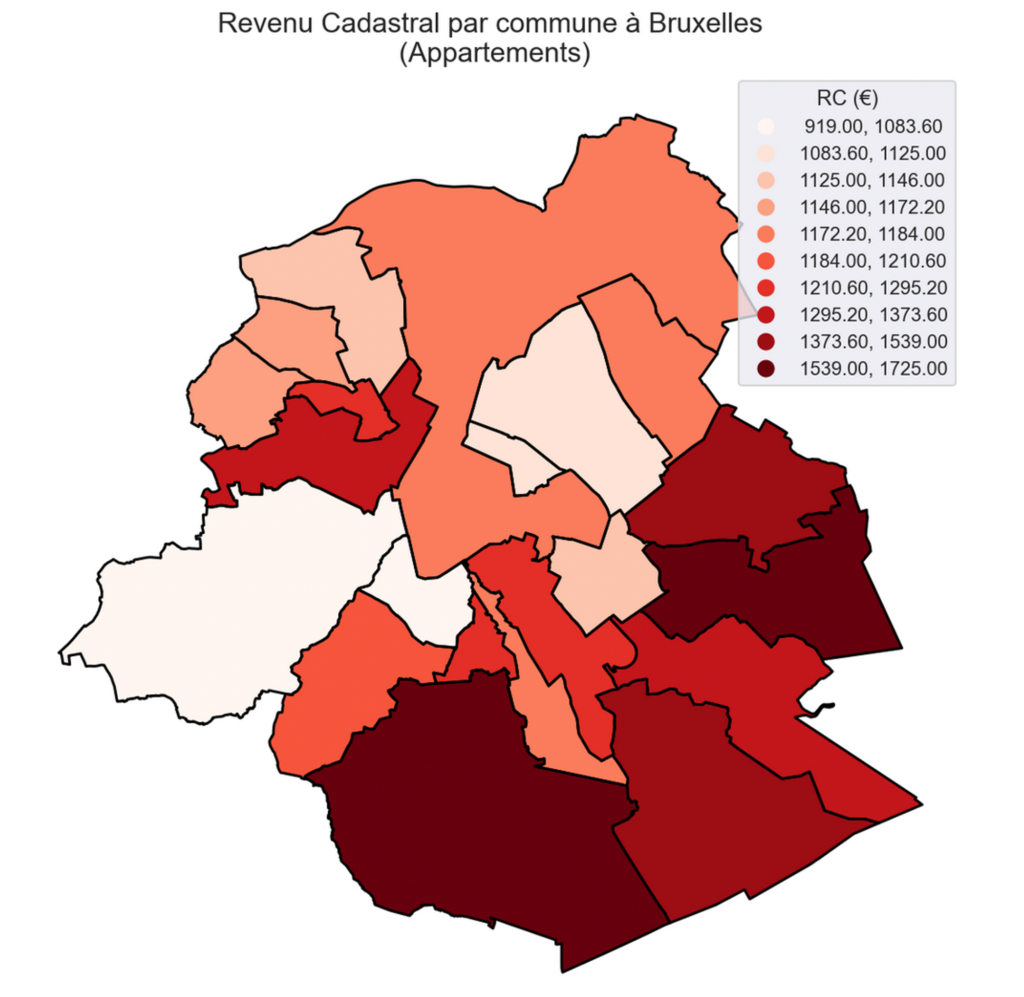

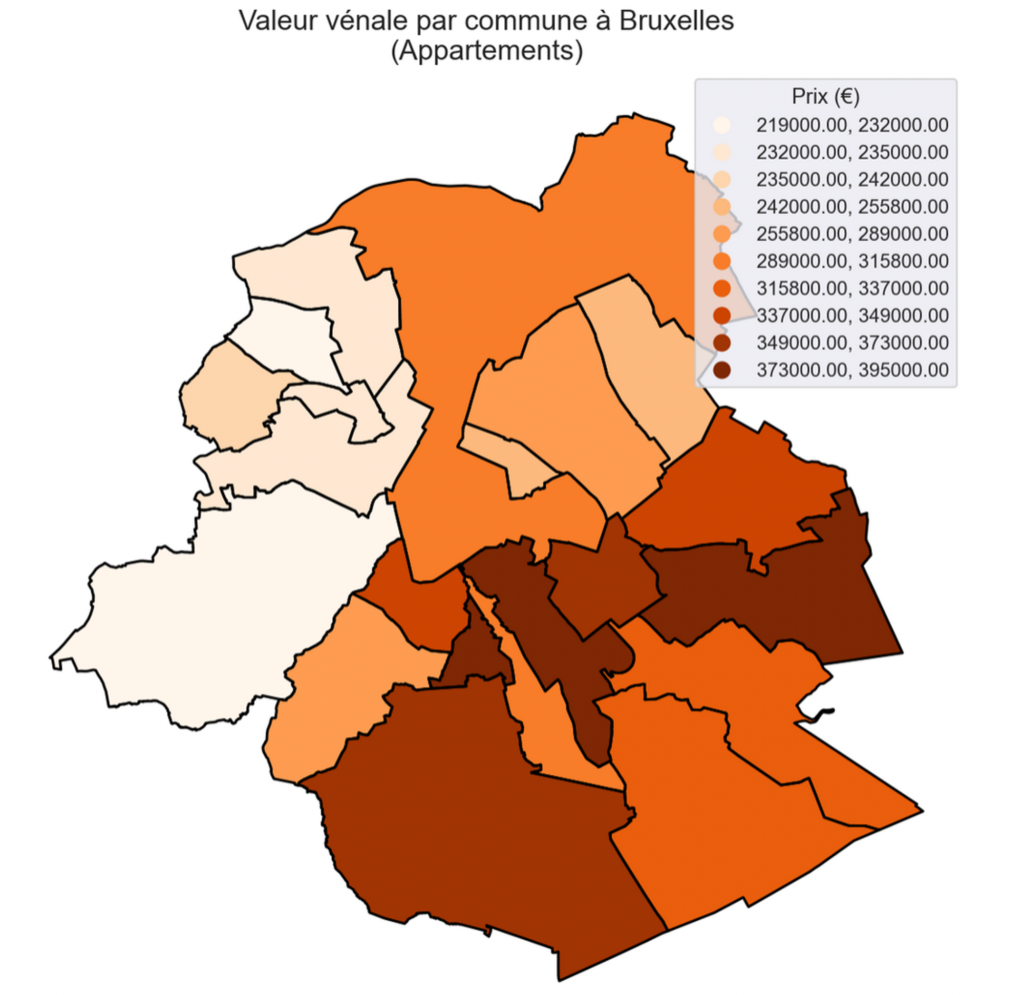

Cadastral Income inequalities in Brussels

We have seen that the Cadastral Income calculated in 1975 may no longer correspond to the state of the market. Some municipalities have seen their prices rise and others their prices stagnate: but all see their CI indexed in the same way.

SmartBlock studied Cadastral Income in the Brussels Region:

The map seems to indicate that the highest CIs are indeed located around the wealthiest municipalities, except for a few cases: Etterbeek, Molenbeek or Koelkeberg have CIs that are either low or high and do not correspond to the current market value.

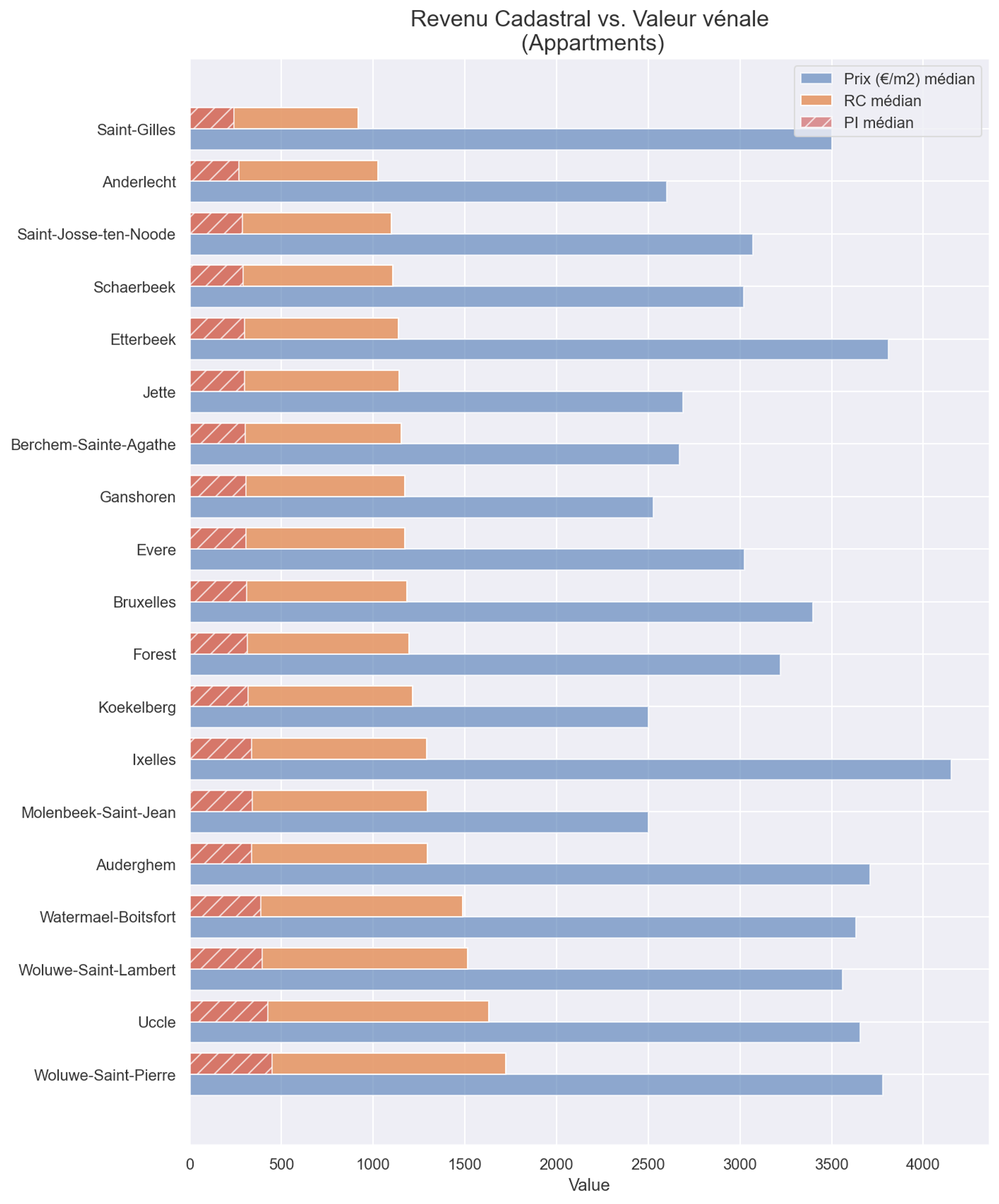

Let’s now visualize the Cadastral Income, Property Tax and Price (€/m2) of each municipality:

The relationship between Cadastral Income and real-estate prices (apartments) then reveals disparities:

- You generally pay a lower Property Tax in Saint-Gilles than in Anderlecht (for the same type of property)

- You pay an equivalent Property Tax between Ixelles and Molenbeek or even Koekelberg, even though the value of properties in Ixelles is 30% higher.

- Etterbeek also shows a very low CI compared with the value of properties on its market.

- The additional centimes, which are determined by the municipality, do not offset this effect.

💡 Why this effect? The Property Tax is based on the Cadastral Income, calculated in 1975. Since 1975 some municipalities have seen their prices soar along with quality of life: Etterbeek, Saint-Gilles are good examples. See: the evolution of prices in Brussels-Capital.

The Cadastral Income did not adapt to this evolution, and some municipalities that did not see the value of their properties change pay the same CI as those whose market has driven prices up.

… and more broadly in Belgium

But this effect is not limited to the Brussels-Capital Region, since CI indexation is identical everywhere. Thus, large disparities are widening between provinces or districts as well as at the national level.

Smartblock studied the median CIs of several Belgian cities, for typical properties: 3-bedroom single-family house and 2-bedroom apartment.

Typical house (3 br.)

| Median Cadastral Income | Median sale price | ratio | |

|---|---|---|---|

| Brussels-Capital | 1.279 € | 459.000 € | 0.28 |

| Namur | 974 € | 275000 € | 0.35 |

| Antwerp | 793 € | 345000 € | 0.23 |

| Liège | 684 € | 199000 € | 0.34 |

| Mons | 683 € | 195000 € | 0.35 |

| Bruges | 675 € | 329000 € | 0.21 |

| Ghent | 552 € | 358000 € | 0.15 |

| Charleroi | 550 € | 169000 € | 0.33 |

Ghent stands out significantly from the other municipalities with a very low average CI compared with high prices (in the top 3) for 3-bedroom houses. Antwerp and Bruges follow for the same reasons.

Typical apartment (2 br.)

| Median Cadastral Income | Median sale price | ratio | |

|---|---|---|---|

| Brussels-Capital | 1.243 € | 294.000 € | 0.42 |

| Namur | 1.086 € | 219.000 € | 0.50 |

| Liège | 981 € | 179.000 € | 0.55 |

| Mons | 975 € | 160.000 € | 0.61 |

| Charleroi | 941 € | 129.000 € | 0.73 |

| Ghent | 902 € | 310.000 € | 0.29 |

| Antwerp | 870 € | 229.000 € | 0.38 |

| Bruges | 862 € | 269.000 € | 0.32 |

It is already noteworthy that the median CIs of a 2-bedroom apartment are similar to the CIs of 3-bedroom houses (while the area is not the same: respectively ~90m2 and ~140m2).

Consequently, the ratio between CI and property value is very high. It is in Charleroi and Mons that it is proportionally very high relative to the median sale price of this type of apartment. Again, the three Flemish cities show a very low CI compared with property prices.

💡 What interpretation? For an identical property, Cadastral Income is not necessarily correlated with real-estate prices (nor with the rental market, which is also correlated with market value). Global indexation does not correct this phenomenon.

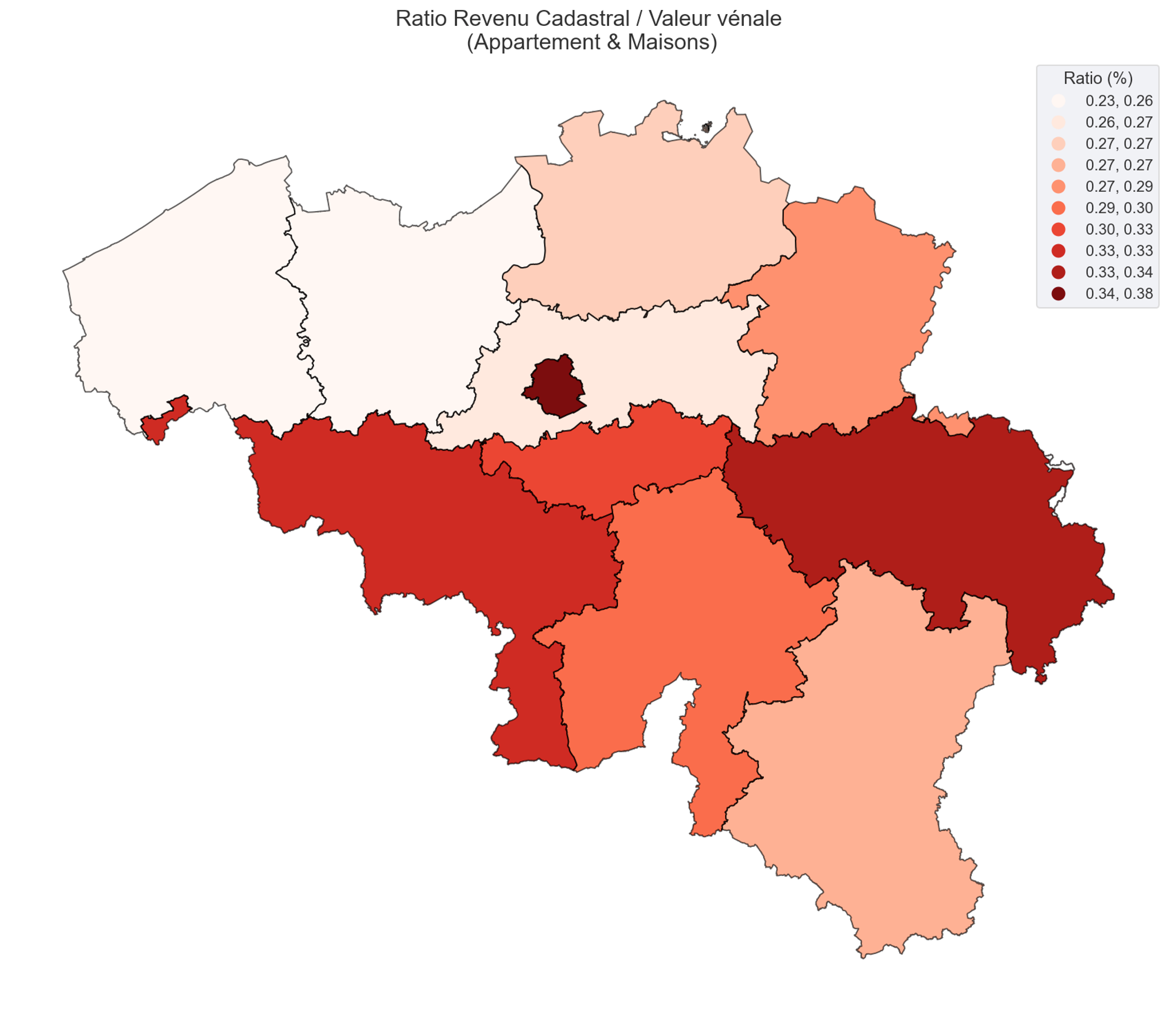

Again, the ratio between CI and Market value highlights the disparities:

- It is the province of Liège that has the highest median Cadastral Income relative to the market values of real estate (houses and apartments).

- It is in Brussels-Capital and in Flanders that Cadastral Incomes are the highest. But Flemings have a particularly low CI relative to the market value of their properties.

- The difference between Flanders and Wallonia is marked, and overall it is in West Flanders and East Flanders that this ratio is the most advantageous.

Conclusion

- The Property Tax is based on Cadastral Income, a notional income established for 1975 and not revised since.

- The evolution of the real-estate market has increased the value of properties in some municipalities without the Cadastral Income being adjusted accordingly.

- There are disparities between neighborhoods and municipalities: for a similar property, the CI is identical in municipalities that have very different real-estate markets (purchase prices, rental market).

- Consequently, owners of properties with a high market value pay a Property Tax similar to properties in less favored areas.

- Revisions of Cadastral Income are done drip by drip when major changes are made to a property. It is then possible to file a complaint if the new CI is inadequate, but it is preferable to come accompanied by an expert and concrete data justifying the CI submitted to the administration.

💡 Are you paying too high a Property Tax? SmartBlock has set up a simulator that makes it possible to calculate your CI and compare it with your neighborhood and municipality.

Other statistical remarks…

- We saw the press get worked up about the increase in additional centimes in certain municipalities in 2023 (e.g., Forest, Schaerbeek). It should be put into perspective that municipal additional centimes represent an overall small share in the calculation of the rate applied to the CI. It is indeed the difference in Cadastral Income between municipalities that drives the differences in PT between municipalities. Example:

- Schaerbeek: 4,191 additional centimes → median PT €290

- Woluwe-Saint-Pierre: 1,725 additional centimes → median PT €451

- On the other hand, the increase in the indexation of Cadastral Incomes from 1.9084 (2022) to 2.0915 (2023) has a real direct impact on the Property Tax, since it is this value that serves as the base multiplied by the regional/provincial/municipal rate.

- Calculating Cadastral Income is not straightforward: SmartBlock tried to calculate the rental income of 200,000 properties and compared it with their indexed Cadastral Income.

- While rental income is correlated with the CI indexed in 2023, the Cadastral Income is lower by a factor of 3 or 4.

- It is difficult to say that the CI corresponds exactly to rental income just as it is difficult to observe a strong link with comfort characteristics often highlighted (presence of central heating, number of bathrooms, etc.).